Ancillary Revenue and Destination Services

In an increasingly competitive environment, travel companies are trying to find new sources of revenue. Both inbound and outbound operators create additional revenue lines to improve profitability and client retention.

Today, destination and ancillary services represent a significant chunk of the tourism industry's income, with different companies fighting over consumer loyalty to their brands.

Airlines, OTAs and tour operators all compete for the same customer.

Industries relying on secondary or ancillary services for profit is nothing new. A typical example is petrol stations, which primarily earn money selling additives such as snacks, drinks and hot dogs rather than fuel itself.

Airlines focus on developing services and products in a highly aggressive market to complement passenger comfort and experience. Some are standard services like extra legroom, and others are special services like a massage at the airport and a haircut upon arrival.

Standard (airline-related) services are products that increase the efficiency and comfort of travel, such as extra baggage, choice of seating on board, extra legroom, special meals or even priority boarding. Non-airline-related services, on the other hand, are additional products that complement the range of airline products. Hotel accommodation, car rental, transfers, activities, insurance, lounge access, complimentary champaign at the gate etc.

The idea is simple. Ancillary services don't add to the cost structure of the airline and are commission based. No risk, pure gain.

Tour Operators and OTAs deliver the same inclusive customer experience, all in the hopes of getting people to spend more time with their brands.

In the past decade, travel agencies have noticed that their customers are interested in ensuring their trips are more memorable, exclusive and customized to their specific needs. A comfortable hotel, good service and facilities are no longer enough. Now, tourists are more often looking for places that offer exciting, educational, and entertaining activities. One of the latest Skift surveys shows that 69% of travelers would rather spend more money on activities than a nicer hotel room.

What does this mean for the travel industry?

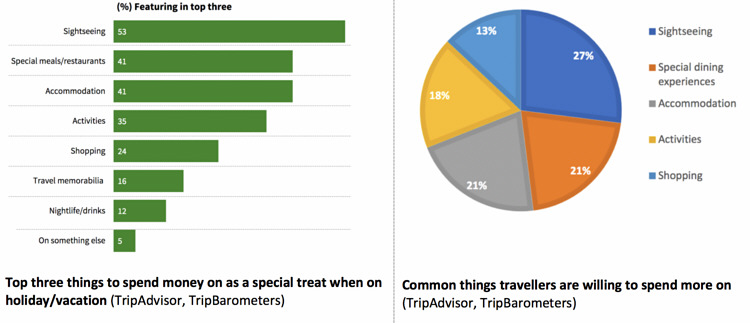

Travel companies need to pay close attention to these figures, as they provide compelling evidence of where the bulk of travel expenditure goes.

According to TripAdvisor, sightseeing achieves the highest priority in holiday spending. Tourists are more likely to spend on sightseeing (53%) than on dinner (41%), accommodation (41%), activities (35%), shopping (24%) and souvenirs (16%).

The situation is similar for young travellers. According to Wyse Travel Confederation, young people prefer to visit cafes and restaurants (64%), visit historical places (63%), go shopping (61%) and undertake outdoor activities like walking and hiking (60%). Less preferred, but still among the most common activities, are visiting museums (53%), living like a local (51%) and finally hitting nightclubs (35%).

To conclude, the potential for activities and excursions is enormous and growing by the year. It is also crucial to note that travellers who book their destination activities ahead of their trip spend 47% more than those who wait to book after arrival(according to Booking.com analysis). So the more we offer potential customers as a fixed/dynamic package, the more we profit.

Similarly, strong partnerships with technology providers that offer tools centered around in-destination activities are highly advised.

Looking to connect activity providers under one hub? Please contact ANIXE.

.

See our dedicated solutions for travel industry representatives:

Tour Operators / Online Travel Agencies / Travel Agents / Destination Management Companies / Airlines