ANIXE Insights 2023.10: Summer Success and September Slowdown Signify Return to Market Stability.

As the summer holiday season draws to a close, the global travel industry sees a promising resurgence from the challenges of the pandemic. According to our data, global bookings have not only rebounded but soared to a remarkable 119% of the pre-pandemic levels seen in September 2019. This surge signifies a steady comeback for the industry, instilling calm as we embrace the return to normalcy. Meanwhile, as autumn sets in, a familiar pattern emerges—a September slowdown, with a 12.7% drop in global bookings from August.

Yet, this post-pandemic September improvement is not shared evenly across regions, and it's in Germany where we see something interesting.

The numbers show that in September 2023, German bookings stood at 97.3% of pre-pandemic levels, mirroring the global trend of a September slump, with a monthly decline of 14.2% compared to August. But here's where it gets intriguing—let's rewind the clock to previous months.

In May 2023, German bookings soared to an astonishing 120% of 2019 levels. By July, that figure had climbed even higher, reaching 148% of pre-pandemic levels. The September slowdown, although seemingly at odds with this summer surge, offers valuable insights into the nature of German travellers.

So, what caused German bookings to transition from record-breaking to a broken record in the span of a single month? It’s a tale of two seasons, and our analysts have been investigating.

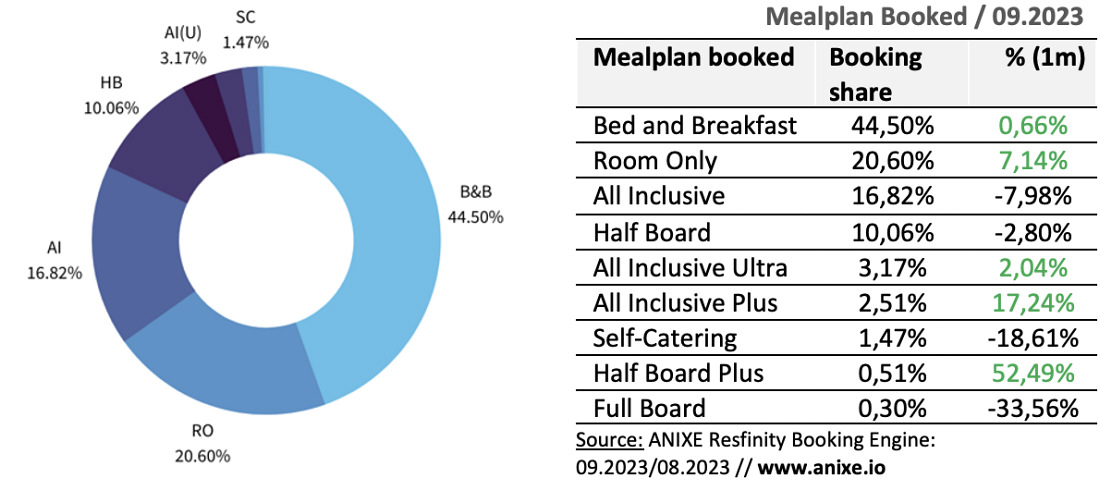

Inflation is significantly influencing German travel patterns. As the cost of living, including energy and daily essentials, rises, travellers are becoming more budget-conscious, leading to discerning vacation choices. Our data indicate a preference for more affordable options, such as bed-and-breakfast accommodations, which constitute 44.5% of total bookings. There's also a 7% monthly increase in room-only reservations, showing a lean towards cost-effective lodging.

The financial strain caused by rising costs has led some German travellers to resort to extreme measures to fund their vacations. According to a survey conducted by Smava.de, a German online comparison site for personal loans and credit, 6% of holidaymakers from Germany admitted to overdrawing their bank accounts to finance their getaways in 2023. This indicates a willingness to prioritise travel experiences even in the face of financial challenges. By September, the survey indicated that 53.9% of Germans had already been on holiday, leaving a mere 9% with plans to travel later in 2023.

While escalating travel costs might discourage a notable 35.8% of Germans (as indicated by Smava.de), the allure of favourable weather is an overriding attraction for most. The data underscores their determination to prioritise travel, even in the face of financial hurdles. Beyond economic factors, the prospect of good weather stands out as the primary driver in German travel choices.

An annual German travel analysis conducted by FUR (2019) underscores this trend. A significant 73% of the 7,500 participants cited good weather as their most treasured memory from their holiday, trumping other factors such as the landscape (70%), regional food and beverage (68%), and the atmosphere (65%). This preference for excellent weather might explain why, despite financial constraints, many Germans opt to travel during the summer rather than risk September showers.

Turning our attention to Spanish travellers, RateHawk – our supplier and partner specialising in booking hotels, airline tickets and transfers – offers some compelling insights into their booking patterns. According to their data, the top 10 outbound destinations for hotel bookings made in August-September by Spanish travel agents in 2023 include diverse locations, ranging from the USA and European countries like Italy and France to Asian favourites like Japan.

What's noteworthy is the significant demand among Spanish travellers for North American destinations. The USA, for instance, secured a 12% share, a rise of 3 percentage points from the previous year. There's also been a marked increase in interest towards Asia. Following the lifting of COVID-19 restrictions in spring 2023, Japan saw a spike in reservations by Spanish travel agents. Meanwhile, although not in the top 20, China is regaining traction as a favoured destination after its Covid-related closures.

These insights resonate with ANIXE’s findings on the transformative patterns in post-pandemic travel. RateHawk also sheds light on the financial aspects of these bookings. The average transaction value of hotel reservations made by Spanish travel agents has risen 11% compared to the previous year. Interestingly, Spanish travellers are trending toward more advanced planning, with the average booking window increasing by 20% compared to last year.

With weather conditions in Europe set to deteriorate as we enter autumn and winter, and with only 9% of Germans saying they expect to travel in the remainder of the year, we expect bookings to slump even further in the coming months. In addition, with inflation creeping up and holidaymakers needing to travel further to guarantee sunshine, we also expect the average prices to increase across the board.

Now, let’s take a deeper look at September’s booking data on Resfinity to see what other insights can be found.

In September 2023, data from ANIXE highlighted that global bookings had soared by over 18% compared to the same period pre-pandemic, with German bookings nearing September 2019 levels. Consistent with ANIXE's forecast two months prior, the demand sustained from July's remarkable volume of reservations into August. However, come post-season September, a decrease of 12.7% globally and 14.27% for the German market was observed. This dip aligns with typical seasonal demand fluctuations, showcasing industry stability that travel agencies can adeptly manage, indicating a positive sign of recovery and adaptability within the travel sector.

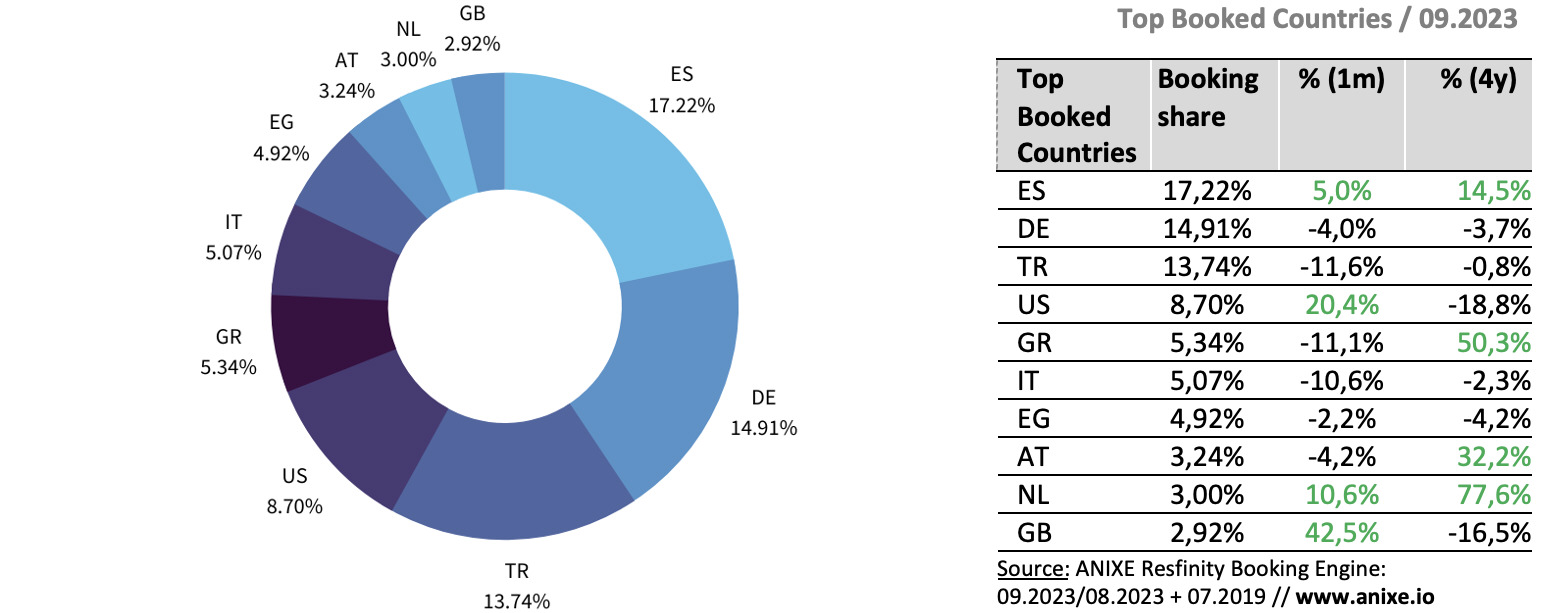

In September, German travellers continued to favour destinations like Spain (17.2%), Turkey (13.7%), and domestic spots (14.9%). Spain experienced a demand boost both month-over-month (5%) and notably when compared to pre-pandemic times (14.5%). Conversely, the US saw a substantial month-over-month growth (20%) yet holds more recovery potential (18.8%) when contrasted with pre-pandemic demand levels.

Turkey and Greece experienced notable drops in travel bookings at 11.6% and 11.1%, respectively, yet Greece's bookings share remained 50% higher compared to pre-pandemic levels, showcasing a relatively stronger recovery despite the decline.

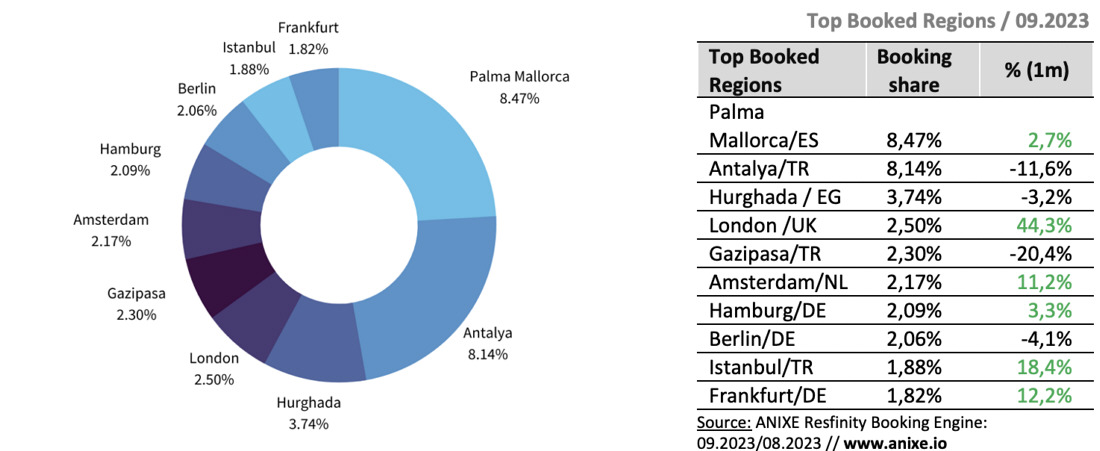

Spain's Palma Mallorca and Turkey's Antalya emerged as favoured destinations. Despite an 8.4% and 24.16% increase in their share from pre-pandemic levels, Antalya experienced an over 11% monthly demand dip, reflecting the high season's end. Conversely, London saw a significant uptick, attracting 44% more tourists in September 2023 compared to August, indicating shifting travel preferences as summer concluded.

Bad news for Gazipasa and Berlin as they witnessed significant declines in travel bookings. Despite a monthly drop of over 20%, Gazipasa's share still stood nearly 35% higher than pre-pandemic levels. Conversely, Berlin saw a further decline of over 4% monthly, with its share remaining 34% lower than pre-pandemic levels. The cause of such declines is multifaceted, but factors such as high airport fees, reducing the number of flights, and unstable weather may have deterred visitors from heading to the German capital.

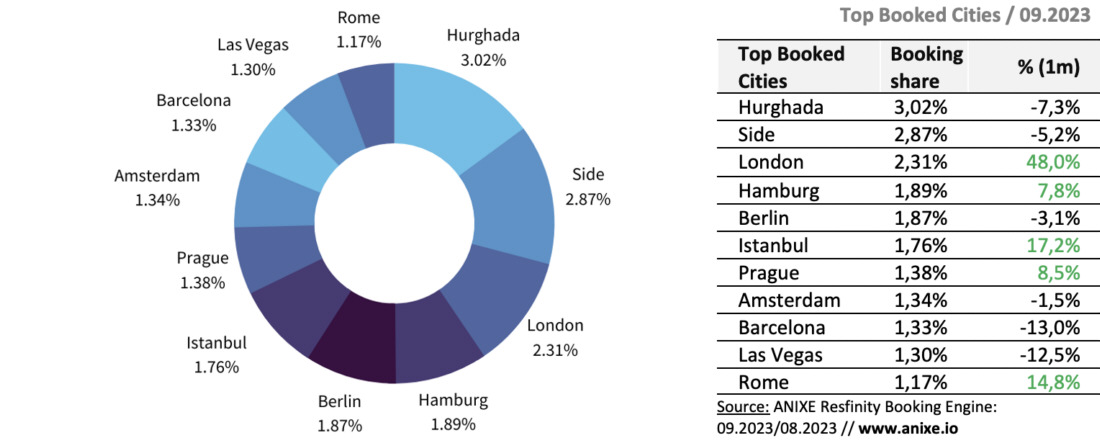

Resfinity data also revealed a shift in preference among German travellers towards Hurghada, Side, and London. Despite a predictable 5-7% decline in holiday bookings for Hurghada and Side, these destinations saw a rise in popularity compared to pre-pandemic levels. Specifically, Side experienced a 6.4% increase in popularity, while Hurghada saw a substantial 13.6% boost in bookings, indicating a continued resurgence in travel interest in these destinations. London experienced a demand surge in September 2023, with a notable 48% monthly popularity increase, yet with nearly 10% growth potential when compared to pre-pandemic levels. Contrarily, Berlin, once a pre-pandemic hit, faced a sharp decline, nearly 50% lower in popularity compared to the same period four years prior, a downturn exacerbated by a further 3% monthly drop. This contrasting trend underlines the varied recovery pace across different European destinations.

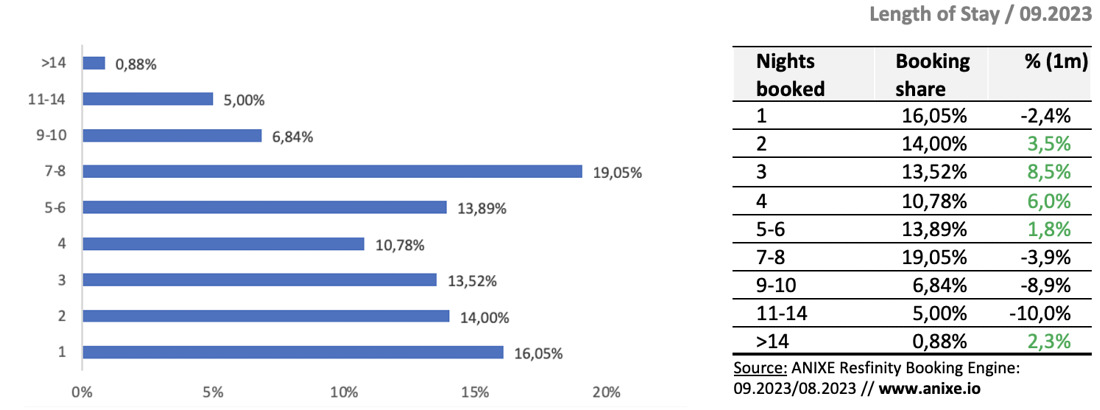

Last month, 7-8 day trips and one-day trips topped the popularity chart. However, compared to pre-pandemic times, 1-day trips have seen a sharp 16% decline. The trend for 2-3 day trips followed suit, decreasing by 5.5%. Conversely, 5-6 day and 9-10 day trips surged by 22% and 35% respectively. Month-over-month, 2-4 day trips gained traction with a 6-8% increase, while the appeal for 9-14 day trips dwindled, facing about a 9% decrease. This data reveals evolving travel preferences, possibly influenced by changing work schedules or a desire for longer escapes amidst ongoing global challenges.

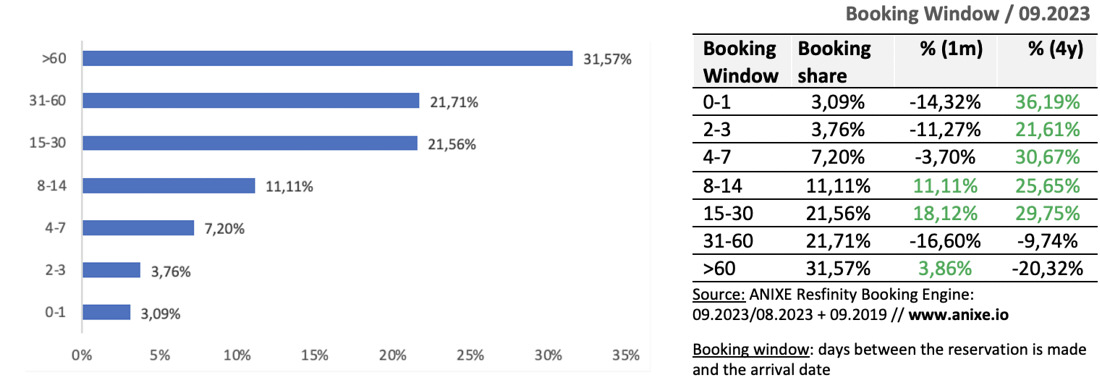

Last month, most German travellers exhibited a forward-thinking booking pattern, with a significant interest in planning trips over 60 days in advance, constituting nearly 32% of all bookings. This reflects a nearly 4% increase from August, though it's 20.3% lower than four years prior. On the other hand, impulsive bookings, made up to 3 days before departure, made up around 13% of the booking portfolio. Despite a nearly 12.5% average share decline, these last-minute bookings are still over 22% higher compared to pre-pandemic levels, indicating more last-minute booking behaviour among German travellers.

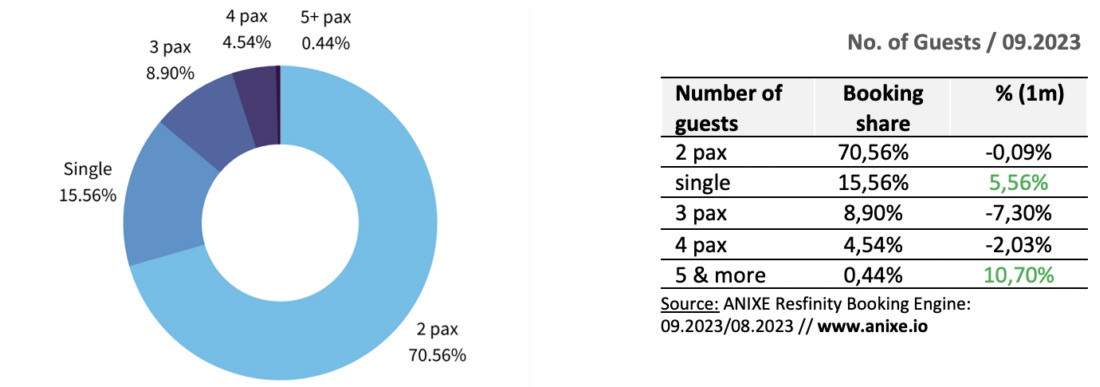

Resfinity's booking data highlights a preference for solo and duo travellers, with bookings for these groups increasing by 5.5% in September compared to August. This reflects a nearly 10% growth compared to the same period before the pandemic. Conversely, bookings for groups of three saw a 7.3% decline month-over-month yet still stood 20% higher compared to pre-pandemic levels, indicating a sustained interest in group travel despite the slight downturn.

ANIXE Resfinity's data showcases a sustained trend where solo or duo travellers favour accommodations with either breakfast included or no-meal options. Bed and Breakfast rooms emerged as the top choice in September 2023, capturing 44.5% of bookings. Despite this strong preference, the figure marks a 7% dip compared to pre-pandemic levels, indicating potential for further growth in this accommodation type.

The observed decline in All-Inclusive bookings, around 8% monthly and also when compared to pre-pandemic times, raises questions. It seems travellers are veering away from all-inclusive options in favour of cost-effective alternatives. The underlying factors require further analysis to determine if this is a temporary deviation or a new enduring trend.

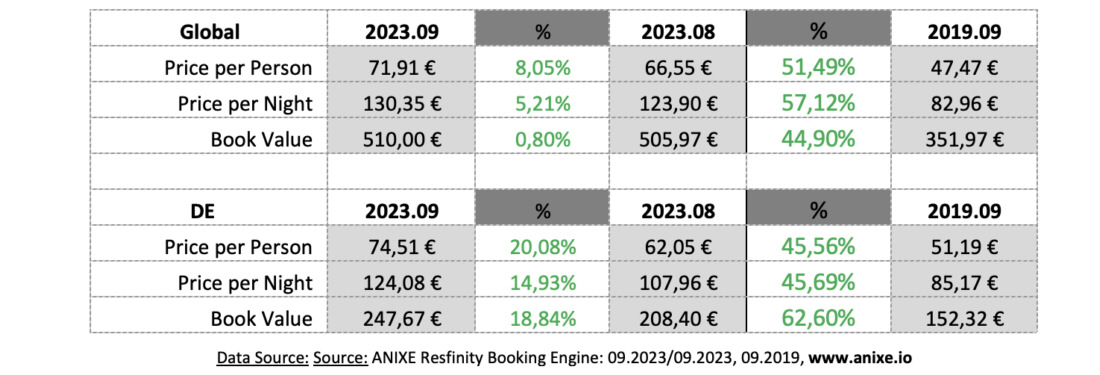

As summer concluded, Resfinity data captured a price surge, likely reflecting a successful tourist season with high demand. Despite overcoming inflationary and unexpected losses such as Europe's fires, the travel sector saw booking costs skyrocket by 62% per person in comparison to four years prior, with global prices up by 45%. This price hike seems to offer less value to holidaymakers, a sentiment proved by the dip in all-inclusive bookings, implying that while costs have escalated, the value of offerings has declined.

The summer we've witnessed is undeniably remarkable. Even as prices escalate, the perceived value of bookings, encompassing meal plans and accommodations, seems to diminish.

Yet, the demand for travel remains unyielding. An unprecedented number of people are demonstrating a willingness to prioritise travel, regardless of the escalating costs. However, as we approach the tail end of the season, September appears less enticing for German travellers. If they're going to invest 'top dollar', they would rather ensure sunny weather.

How will travel agencies and tour operators adjust their strategies for next year based on these insights?

As we transition deeper into autumn, will sales continue to decelerate? Will the trend of rising prices accompanied by diminishing value persist?

Find out in our next report. So, for now…

Stay tuned. Stay safe. Plan your trips. Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.)

.