ANIXE Insights 2023.12: From Slow Season to Snow Season: Travel Bookings Set to Soar.

Winter is coming, and for those of us in the travel industry, that is only a good thing. Ski holidays, winter getaways, and the advent of the Holiday Season all mean increasing demand for travel products and services. The last few months saw a lull in bookings, but it's just the calm before the ‘snow’-storm.

Around the world, everyone is gearing up for another record-breaker. The American Automobile Association (AAA) projects this winter to be one of the busiest on record, with a notable resurgence in travel activity. Key factors driving this surge include favourable weather conditions and a substantial decrease in petrol prices, encouraging more people to embark on road trips and overall travel.

Although European prices at the pump aren’t as low as the US, we still expect a winter boom in travel demand for very different reasons. Europe is gearing up for an exceptional winter season, thanks in part to the El Niño weather pattern, which is predicted to bring increased snowfall and colder temperatures across the continent. This climatic shift is especially beneficial for ski resorts and winter tourism destinations, which are anticipating higher visitor numbers than ever before.

For a different breed of European, the prospect of colder weather and more snow means that winter sun on far-off beaches is on the agenda. More long-haul international destinations will be in vogue as temperatures drop at home.

And, of course, it’s the holidays, the time of year when most of us reconnect with our loved ones, which oftentimes entails using some aspects of the travel industry.

It’s good news all around, as the The World Tourism Organization (UNWTO) reports that international tourism is on track to recover almost 90% of pre-pandemic levels by the end of 2023. An estimated 975 million tourists traveled internationally between January and September 2023, marking an increase of 38% compared to the same period in 2022. This recovery is underpinned by strong performance in various regions, with Europe welcoming 550 million international tourists, representing 94% of pre-pandemic levels. The Middle East has even surpassed 2019 levels by 20%.

Now, let's take a deeper look at November's booking data on Resfinity, where we see a more optimistic picture than the UNWTO.

In November 2023, ANIXE data showed that global bookings increased by more than 6% compared to the same period before the pandemic, while German bookings remained 6.8% lower than before the pandemic.

According to ANIXE's forecast four months ago, very high demand continued from July to August. However, after the end of the season, gradual declines of 10% were observed on average, while in Germany, monthly declines were at a much lower level of 5.4%.

These decreases align with typical inter-seasonal fluctuations in demand, showing the industry's stability, which travel agents can skillfully manage, indicating a positive sign for recovery and adaptability in the tourism sector.

In November, German travellers continued to favour destinations such as Spain (15.4%), the USA (12.3%) and domestic destinations (17.0%). However, the share of the latter two, despite significant increases in popularity on a monthly basis, was more than 14.8% lower than in the corresponding period before the pandemic. In contrast, although Spain saw a slight decrease on a monthly basis (-5.2%%), its popularity and share of bookings is nearly 40% higher than in 2019.

Turkey and Egypt saw significant decreases in travel bookings at 27.4% and 9.8%, respectively, but Turkey's share of bookings is still 14.2% higher than in the pre-pandemic period. Unfortunately, the same cannot be said for Egypt, where the war unfolding in the Gaza Strip next door is heavily impacting the sense of security in the region, leaving the pyramid country's current popularity nearly 39% lower than in the same period four years ago.

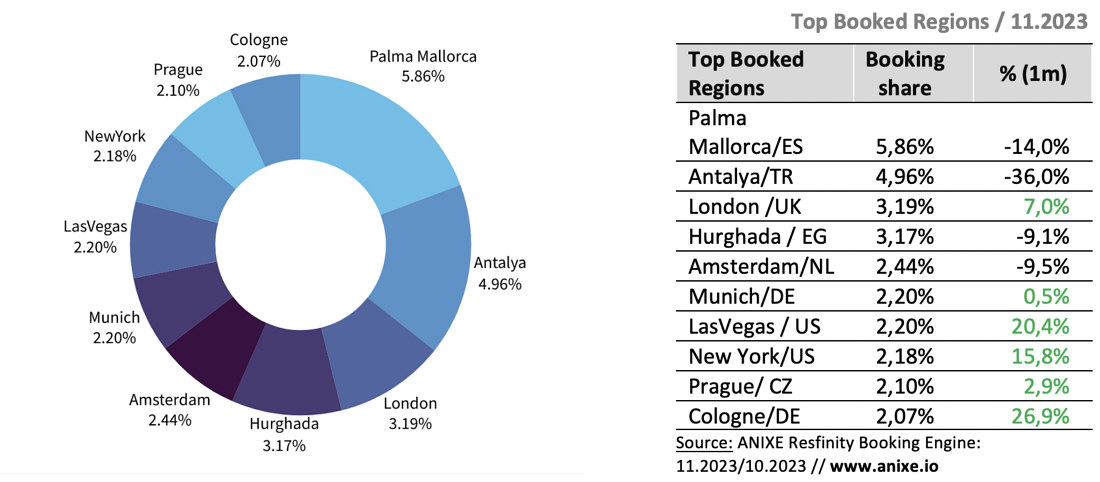

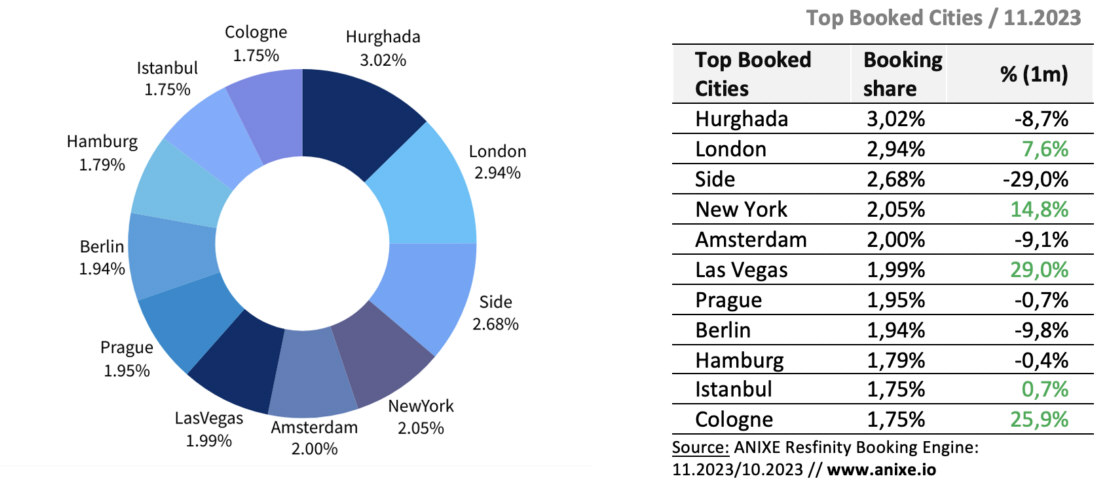

Spain's Palma Mallorca and Turkey's Antalya proved to be the favourite destinations. Despite share increases of as much as 34.9% and 28.59% over pre-pandemic levels, both experienced post-seasonal monthly demand declines of 14% and 36%, respectively. On the other hand, London saw another month of significant growth, attracting 7% more tourists in November 2023 compared to October. However, a comparison with the pre-pandemic period shows its share up by as much as 40% over the same period.

The bad news came from Hurghada and Amsterdam, which saw significant declines in travel bookings. Despite a monthly decline of more than 9.5%, Amsterdam's share was still almost 75% higher than before the pandemic. On the other hand, Hurghada saw a further decline of more than 9% per month, and its share remained less than 40% lower than before the pandemic. The ongoing armed conflict between Palestine and Israel certainly influences the declining popularity of Egyptian resorts. Exceptional promotions and price reductions are useless and cannot fully compensate for declining demand.

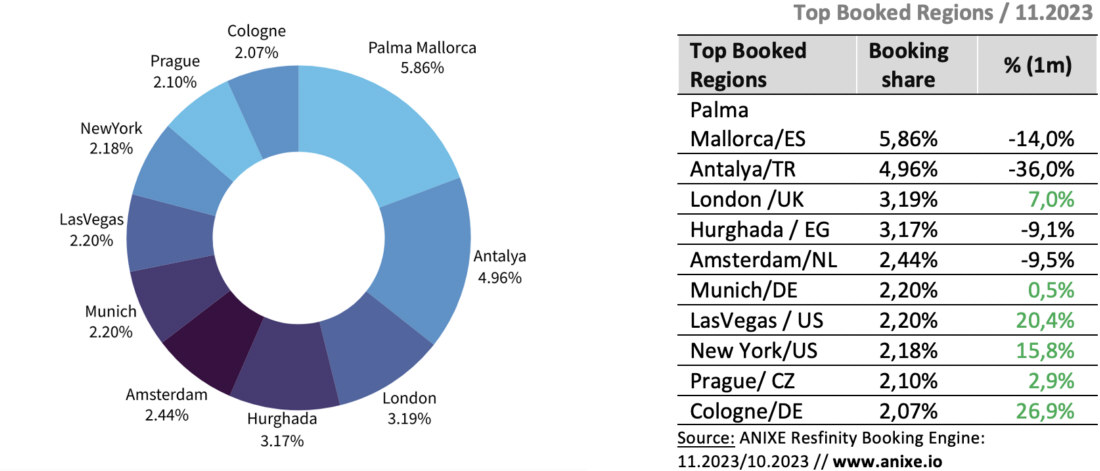

Resfinity's data also revealed the scale of preference among German travellers in the area of the existing leaders: Hurghada, London and Side. Although both Side and Hurghada scored large declines (Side), the value of their popularity is still higher than before the pandemic - 6.4% and 13.6%, respectively.

London experienced a sizable increase in demand from September-November, with a noticeable 7.6% monthly increase in popularity, but with almost 9.7% growth potential compared to pre-pandemic levels. In contrast, once pre-pandemic hits, Berlin and Istanbul saw a sharp drop in popularity of over 45% compared to the same period four years earlier.

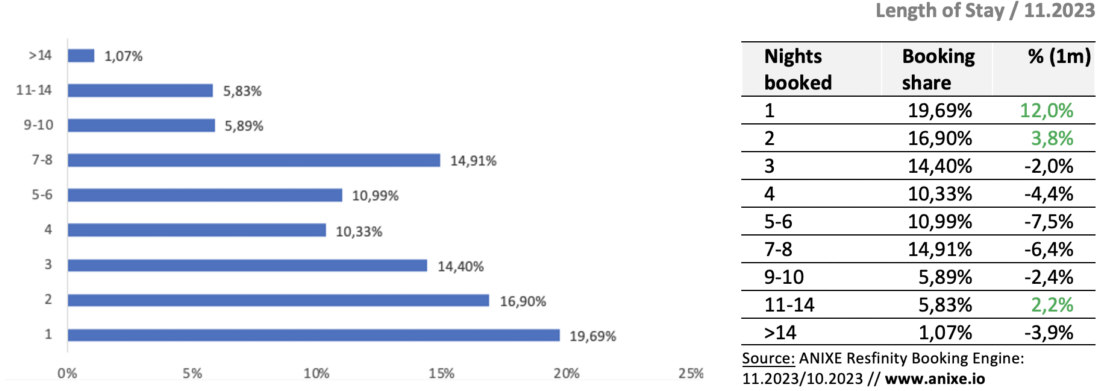

Last month, 7-8 day trips and day trips topped the popularity ranking. However, compared to pre-pandemic times, 1-day tours saw a sharp decline of 22.6%. The trend of 2-3-day trips followed suit, declining by 5.6% and 1.6%, respectively. In contrast, 5-6 day and 9-10 day trips increased by 32.6% and 27,9% respectively. Month-on-month, 2 day trips gained in popularity, recording an increase of 3,8%, while the appeal of 9-14 day trips declined, recording a decrease of around 5,8%. These figures reveal changing travel preferences, probably influenced by changing work engagement schedules.

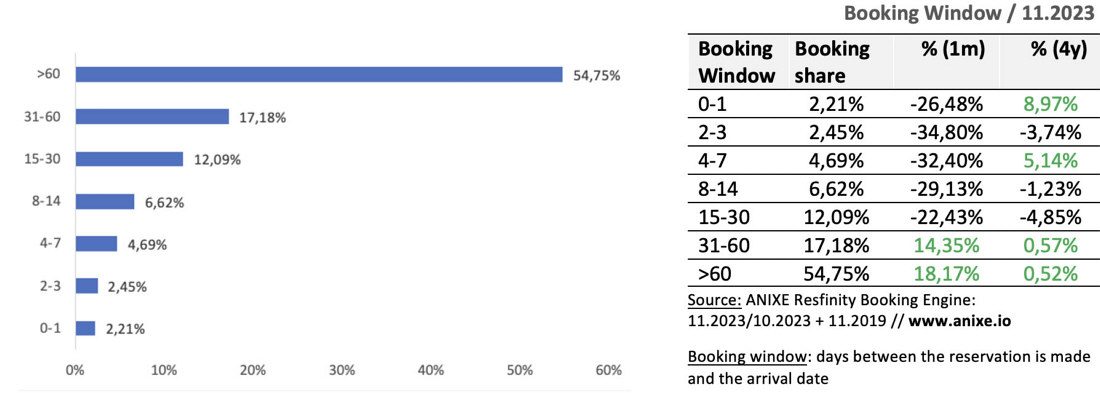

Last month, most German travellers showed forward-thinking, with a significant interest in planning travel more than 60 days in advance, accounting for more than 54% of all bookings. It reflects an increase of more than 18% compared to October and is at the same level as before the pandemic. On the other hand, impulsive bookings, made up to three days in advance, accounted for nearly 5% of the booking portfolio. Despite a drop of around 30% in the average share, these last-minute bookings are 9% higher than before the pandemic (0-1 day) and 3.8% lower for those 2-3 days.

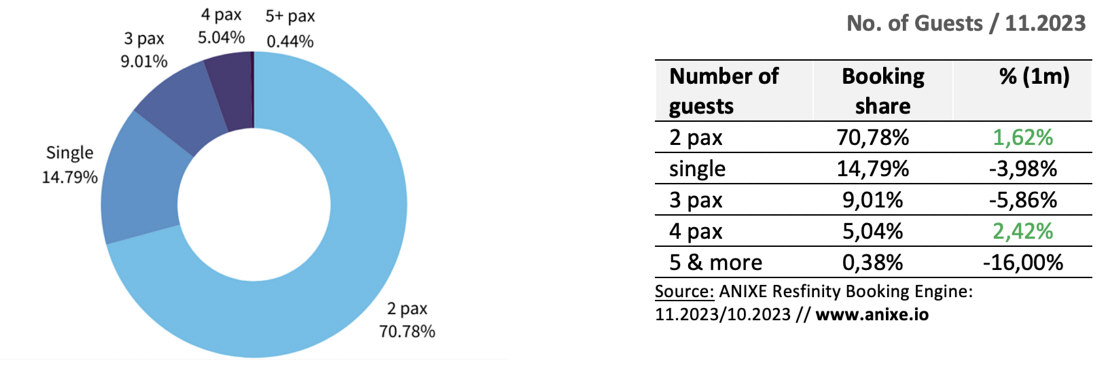

Resfinity's booking data highlights a preference for single and duo travellers, with bookings for couples up gently by 1.6% in November compared to October. A comparison with the pre-pandemic period shows 3.2% growth. In contrast, bookings for groups of three experienced a 5.9% monthly decline but were still 19% higher compared to pre-pandemic levels, indicating continued interest in group travel despite the slight slowdown.

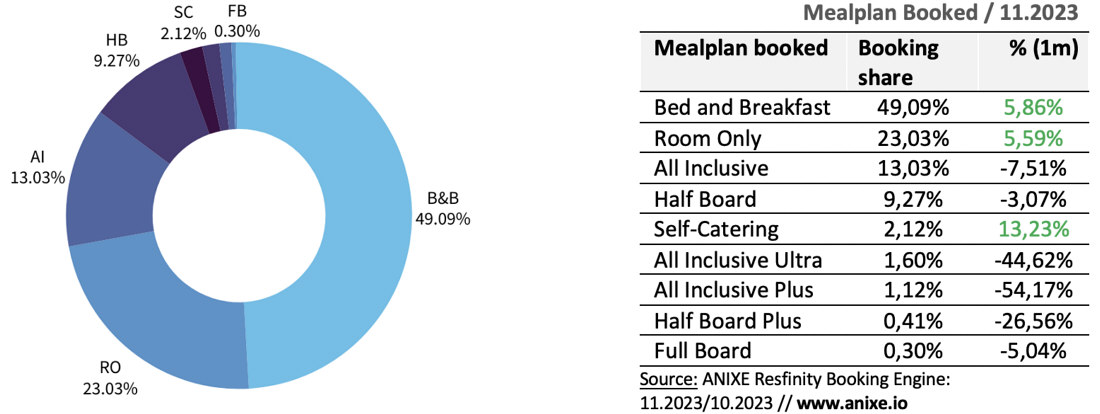

ANIXE Resfinity's data shows a continuing trend, with solo and duo travellers preferring accommodation with breakfast included or without meals. Bed and breakfast rooms became the most popular choice in November 2023, garnering a whopping 72.1% of bookings. Despite this strong preference, this figure represents a decrease of 8.5% compared to pre-pandemic levels, indicating the potential for further growth in this accommodation type.

The observed decline in All-Inclusive bookings by around 7.5% per month compared to pre-pandemic levels raises questions. It appears that travellers are moving away from all-inclusive options in favour of cost-effective alternatives. The underlying factors of this phenomenon require further analysis to determine whether this is a temporary deviation or a new sustainable trend.

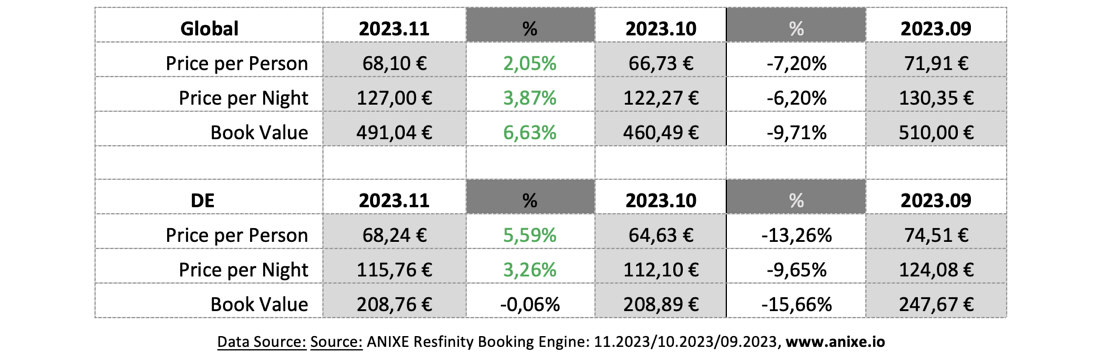

With the end of the summer, Resfinity's data recorded a short-lived price increase, probably reflecting a successful tourist season with high demand. However, October firmly corrected the inflated level, thus boosting demand in a less busy period. In November, prices started to rise gently again, and this increase is expected for the rest of the year.

In conclusion, as 2023 draws to a close, the travel industry is poised for a merry winter season. Data from Resfinity shows a positive trend, with increasing demand for varied travel experiences and destinations. This signals a robust recovery and an exciting period of growth, offering new opportunities for both travellers and industry stakeholders.

Just how record-breaking will the new year be?

Find out in our next report. So, for now…

Stay tuned. Stay safe. Plan your trips. Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.)

.